At the end of 2020, the Central Economic Work Conference set the goals that China will strive to peak its carbon dioxide emissions by 2030 and achieve carbon neutrality by 2060. In 2021, the strictest-ever plastic ban officially took effect nationwide. Against this backdrop, the degradable plastics industry has recently become a market focus.

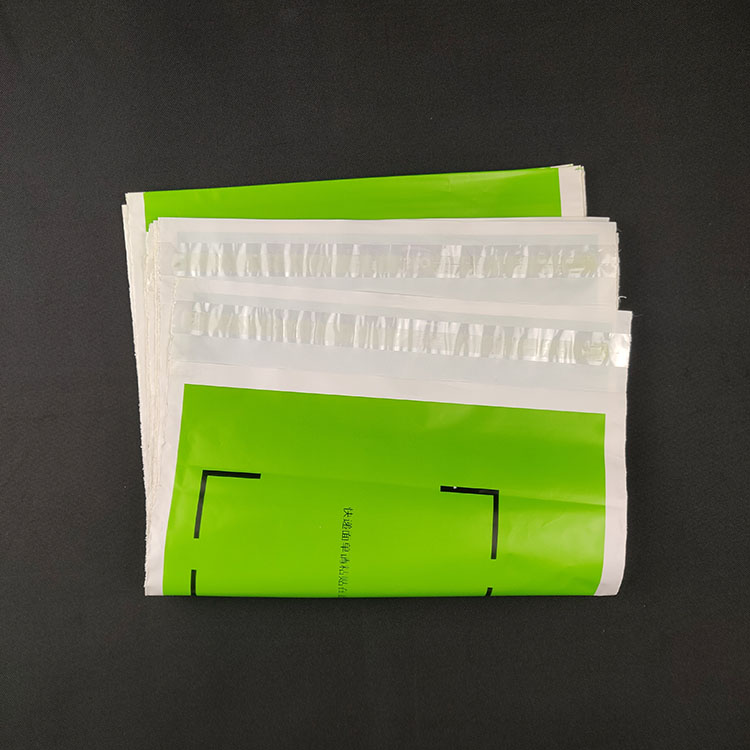

Some securities research reports suggest that the degradable plastics market holds a potential worth hundreds of billions of yuan, and related chemical enterprises are poised to stand on the "policy wind" and reap policy dividends. The Opinions on Further Strengthening the Governance of Plastic Pollution proposes that comprehensively banning the production and sale of certain plastic products, promoting green plastic products, and exploring new business formats have become important approaches. As one of the key initiatives, degradable plastics have attracted significant attention.

It is understood that biodegradable plastics are the major category of degradable plastics. The representative polylactic acid (PLA) and polybutylene adipate terephthalate (PBAT) can achieve complete degradation, thus being regarded as the most promising degradable plastics.

From the perspective of industry status quo, PLA production in China is still in the initial development stage, with the current domestic annual output standing at around 300,000 tons. Among domestic producers, two leading enterprises—Jiangsu Yunyoucheng and Hainan Longdu Tianren—each have an annual production capacity of 50,000 tons, while the capacity of most other companies remains at 20,000 tons per year. In contrast, the domestic annual production capacity of PBAT has reached 220,000 tons, with under-construction capacity exceeding 20 million tons.

Driven by favorable policies, the prices of PBAT and PLA have surged sharply recently. The current domestic price of PBAT is around 26,000 yuan per ton, registering a 13% month-on-month increase. Meanwhile, the price of PLA has skyrocketed from 20,000 yuan per ton at the end of 2019 to approximately 40,000 yuan per ton at present.

China is currently a major global plastic consumer, accounting for 15% of the world's total plastic consumption. Relevant data shows that the scale of China's plastic packaging market reached 54.1 billion US dollars in 2019. Shenwan Hongyuan Securities believes that PBAT and PLA have a high cost-performance ratio and are expected to be the first to benefit from the market boom. Among the eight major categories of biodegradable plastics, PBAT and PLA have performance closest to that of traditional plastics; they can be blended to further enhance performance while featuring relatively affordable prices. Moreover, the technologies for these two products are relatively mature, making them the main products for domestic capacity expansion in the future. The large-scale production of PBAT and PLA is expected to further reduce costs, which will facilitate product promotion and drive rapid growth in demand.

Overall, China's degradable plastics market boasts broad prospects and promising industry development, and the performance of related degradable plastic enterprises is bound to be significantly released.

Tianfeng Securities stated that favorable policies for the degradable plastics industry will be officially implemented, and in the short to medium term, these policies will drive market development. According to estimates, the market demand for degradable plastics in the sectors of express delivery, food delivery, agricultural mulch films, and packaging plastic bags can reach 920,000 tons, 220,000 tons, 400,000 tons, and 440,000 tons respectively, totaling 1.98 million tons, corresponding to a market value exceeding 30 billion yuan.

Medium to long-term policy dividends have also stimulated market capital to invest in some stocks in the sector. An analysis of social security fund holdings reveals that some degradable plastic stocks have gained attention from institutions that adhere to value investment concepts. Statistics show that by the end of the third quarter of last year, social security funds appeared among the top 10 tradable shareholders of 5 stocks in the sector, namely Hengli Petrochemical, Hainan Rubber, Efane Pharmaceutical, Sanlian Hongpu, and Guoen Co., Ltd.

The latest research report from Shenwan Hongyuan Securities maintains an "overweight" rating on the industry. It holds that the temporary supply shortage of products such as PBAT and PLA has resulted in strong product premium capacity and considerable profitability. In the short term, the progress of PBAT capacity construction and the technology digestion progress after PLA technological breakthroughs will be the key factors determining whether various companies can seize the window period of product premiums. In the medium to long term, the sustainability of policies and the cost-reduction capabilities of various companies will be the decisive factors. Specific stocks worthy of attention include Kingfa Technology, Changhong High-Tech, Jindan Technology, Ruifeng High Materials, and Tonking New Materials.

Article Title: The Degradable Plastics Industry Enters Its "Spring" URL: https://en.szxylp.com/news/industry-news/the-degradable-plastics-industry-enters-its-spring.html